The Housing Crisis and Corporate Greed

With the recent legal action against RealPage, now’s as good a time as any to look at what corporations have done to destroy an internationally recognized human right: housing.

The Erosion of Housing Affordability

If there’s one aspect of society in which American values reign supreme, it’s the equal opportunity with which it will allow a diverse array of companies to exploit the working class.

Rest assured, just like any other industry in this capitalistic structure, the housing market suffers no shortage of ravenous scavengers champing at the bit to exploit the various aspects of the market and fleece ordinary people, just like you.

Obviously, the aforementioned RealPage is one of these known agents working against the working class, but it is hardly alone. So, who are the others?

Companies like Zillow, Airbnb, and Invitation Homes have each managed to contribute to the erosion of housing affordability and stability in their own special way.

All the while, the dream of home ownership or even just secure housing continues to steadily drift further out of reach for a record number of Americans.

RealPage Lawsuit: The Latest in a History of Litigation

The most recent RealPage scandal is more than just a standalone incident; it is a clear indication of how profoundly broken the housing system has become.

By providing a platform for landlords to coordinate rent increases, the oft embattled RealPage has effectively transformed what should be a fair and competitive market into a rigged game, one where renters stand little chance of winning.

Instead of fostering normal market competition that facilitates affordable housing options, RealPage created an environment where renters were the inevitable losers, caught in a cycle of escalating costs and dwindling options, amid a period of stagnant and even declining wages.

Since the 2010s, RealPage has repeatedly been scrutinized for its monopoly practices and antitrust concerns, prompting any reasonable person to question, how is it even still around?

RealPage weaponized rent-setting software, empowering landlords to conspire in rent gouging.

In 2018, the company faced a significant data breach that exposed the personal data of thousands of renters, raising serious concerns about its data protection practices. A year later, RealPage was criticized for its tenant screening processes, which allegedly provided inaccurate or outdated information, leading to wrongful denials of housing applications.

The actions of RealPage are not just isolated attacks on renters; they are a symptom of a much larger, systemic issue. The housing market has devolved into a playground for corporate entities who worship at the altar of profitability, usually at the expense of basic human needs.

Airbnb: There Goes the Neighborhood

Despite beginning its life as a platform for short-term rentals, Airbnb has subsequently impacted long-term housing availability in a major way.

What once seemed like a trendy, hip new way for homeowners to earn extra income, like so many late-aughts startups seeking to “disrupt” Airbnb has, over time, severely disrupted the quality of life for the working poor nationwide—nay, worldwide.

The lure of higher profits from short-term rentals has prompted many landlords to switch their properties from long-term leases to short-term accommodations. This shift has further driven up rents, making it increasingly difficult for local residents to afford to stay in their communities.

As a result, long-term tenants are often forced to vacate, finding themselves priced out of their own neighborhoods.

Airbnb displaced long-term residents, turning homes into profit-driven short-term rentals.

The transformation of once-quiet communities into transient rental zones dominated by tourists has also eroded the sense of cohesiveness that many residents once cherished.

Take Hawai’i, a paradise not without its own history of unwelcome visitors. In a study that sought to understand how the onslaught of short-term rentals impacted them, residents of Oahu lamented what they described the loss of “the sense of place, of the neighborhood.”

The rise of Airbnb has highlighted a classic capitalist tendency: the prioritization of profit over people. With its distorted model of housing, driven by short-term financial gains, Airbnb’s strategies have

By GeneParmesan66 - Own work, CC BY-SA 4.0, Link

Zillow: Automated Market Manipulation

Once known as an unassuming, user-friendly real estate listing platform, in the early 20s, Zillow dramatically shifted its role in the housing market with the introduction of its controversial iBuyer program. Through this program, Zillow began purchasing homes in large quantities, with the intent to quickly flip them for a profit.

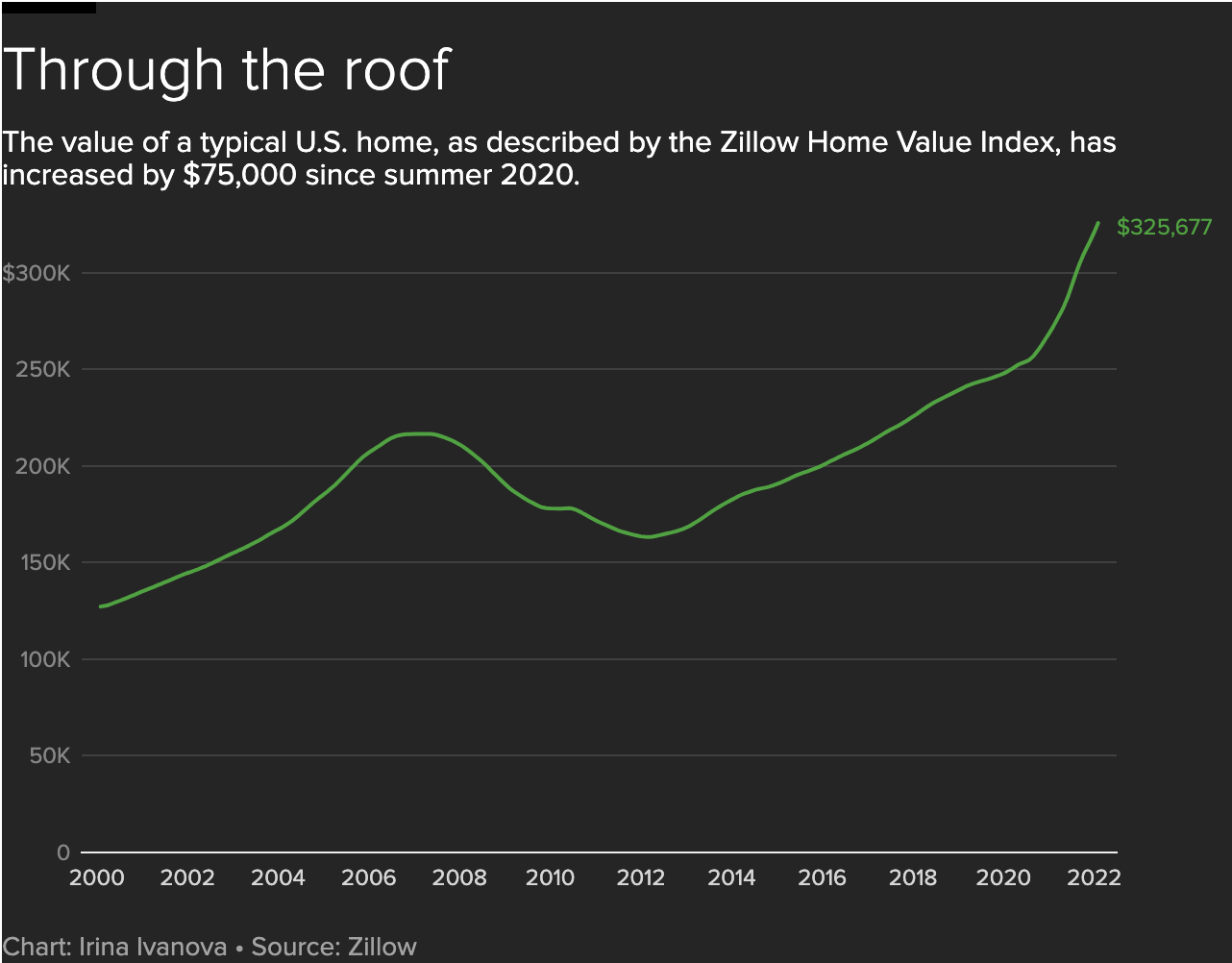

While your run-of-the-mill capitalist would herald this as a masterful business strategy, it has had severe consequences for the housing market across the country. By buying up properties en masse, Zillow contributed significantly to the inflation of home prices, making it even more challenging for average Americans to afford a home.

This greedy gobbling up and flipping strategy drove up prices in markets that were already competitive, pushing home ownership further out of reach for many. The impact has been felt most acutely by first-time buyers and those in lower-income brackets, who find themselves unable to compete with a corporate giant that can outbid them and then set higher resale prices.

Zillow manipulated the housing market, driving up home prices through mass property flipping.

The hyper-commodification of housing—viewing homes primarily as investment opportunities rather than basic human needs—has left countless would-be homeowners out in the cold, often literally, with no realistic path to achieving their dreams.

Zillow’s shift from a platform that helped people find homes to an active player in driving up home prices exemplifies the broader issue of housing becoming an investment commodity rather than a necessity for living. This transformation has deepened the divide between those who can afford to buy a home and those who cannot, exacerbating the housing crisis.

While its actions are clearly indifferent to human life, there are other offenders whose names could easily be interchanged in any of the complaints levied against Zillow. Redfin, Opendoor and number of copycats, each of whome attempted to enrich stakeholders at the expense of people in need of affordable housing.

Invitation Homes: Engineering A Housing Monopoly

Invitation Homes represents yet another facet of corporate exploitation within the housing market, with a particular focus on large-scale property investments.

By aggressively acquiring significant amounts of property, often in rapidly developing or desirable areas, Invitation Homes has played a key role in tightening the housing market.

This strategy has left even fewer options for potential homeowners, driving up home prices and making it increasingly difficult for the average American to afford a place to live.

Invitation Homes monopolized housing supply, tightening the market and inflating property values.

The corporate stranglehold that Invitation Homes exerts on housing availability creates an environment where home ownership is reserved for those with the deepest pockets, further widening the gap between the wealthy and everyone else.

The practice of mass property acquisition not only reduces the supply of available homes but also inflates property values, pricing out middle and lower-income buyers who are already struggling in a competitive market.

The impact of Invitation Homes' strategy is not just financial; it is a profound social issue. As housing becomes more scarce and expensive, the possibility of owning a home slips further away from reach. This dynamic exacerbates existing inequalities, ensuring that wealth continues to concentrate in the hands of a few while the majority are left with dwindling opportunities for stability and upward mobility.

The Increasing Reality of Houselessness

As rents continue to soar and the housing crisis worsens, the rise in houselessness is has been a heartbreaking consequence. For many, the idea of losing their home has transitioned from a distant fear to a looming reality.

Families who once lived paycheck to paycheck now find themselves unable to keep up with rent hikes, forcing them into shelters, onto friends' couches, or, in the worst cases, onto the streets.

Houselessness is no longer an issue on the fringes; it has become a daily reality for working-class families priced out of their homes. The rise of tent cities, where people who have been displaced by skyrocketing rents seek shelter, is a stark indicator of the housing system's failures. These makeshift communities are the direct result of a market manipulated by corporate giants.

By GeneParmesan66 - Own work, CC BY-SA 4.0 link

The Human Cost of Corporate Greed

To be clear, the housing crisis gripping America today didn’t suddenly will itself to life. It’s the result of years of deregulation, lobbyist cronyism and failed policy and a market increasingly driven by profit rather than people’s needs.

While companies like RealPage, Invitation Homes, Zillow and Airbnb have played a central role in turning the housing market into an exclusive club for the affluent, they represent only four of the countless conglomerates and hedge fund companies playing god with people’s housing.

This gradual erosion of affordability has reached a critical point, where many are struggling just to keep a roof over their heads.

A System That Bites the Hand that Feeds It

The bitter irony of the ongoing housing crisis is that the very taxpayers who bailed out the housing industry during the Great Recession—saving banks, mortgage companies, and the entire financial system from collapse—are now suffering the consequences of an even worse housing reality.

In particular, the historically overtaxed working class shouldered the brunt of the TARP bailouts, while the rich paid virtually nothing.

What was supposed to be a taxpayer funded bailout to avoid a complete financial collapse ended up being funding for golden parachutes and bonuses for the very same C Suite execs who were ultimately responsible for the collapse.

Despite the trillions of taxpayer dollars spent to stabilize the market, the restructuring that followed only served to empower corporate giants like RealPage, Zillow, Airbnb, et al.

As the middle and lower classes continue to be plagued by rising costs and shrinking opportunities, the call for accountability grows louder. The RealPage scandal may be the latest flashpoint, but it should serve as a catalyst for resistance and direct action.

Given the adverse effects of these practices—gentrification, evictions, homelessness— it’s become clear that something has got to give. With a legislature that is either unwilling or incompetent legislature that allows the corporations who practice them to continue unimpeded, it’s becoming increasingly difficult to see this indifference as anything but complicity in the war on the middle class in this country.